Life Insurance in and around Otsego

Coverage for your loved ones' sake

Now is the right time to think about life insurance

Would you like to create a personalized life quote?

State Farm Offers Life Insurance Options, Too

Taking care of those you love is what keeps you going every day. You advise them on important decisions listen to their concerns, and take time to plan for the future. That includes getting the proper life insurance to care for them even if you can't be there.

Coverage for your loved ones' sake

Now is the right time to think about life insurance

State Farm Can Help You Rest Easy

Some of your options with State Farm include coverage for a specific time frame or level or flexible payments with coverage designed to last a lifetime. But these options aren't the only reason to choose State Farm. Agent Jeremy Weitting's considerate customer service is what makes Jeremy Weitting a great asset in helping you pick the right policy.

State Farm offers a great option for individuals who thought they couldn't qualify for life insurance: Guaranteed Issue Final Expense. This coverage can come in handy by covering final expenses like medical bills or funeral costs, ensuring that your loved ones won't have to bear the burden. For a free quote on Guaranteed Issue Final Expense, contact Jeremy Weitting, your local State Farm agent and see how you can be there for your loved ones—no matter what.

Have More Questions About Life Insurance?

Call Jeremy at (269) 692-6831 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

Irrevocable life insurance trust for a single person

Irrevocable life insurance trust for a single person

Estate taxes are imposed on all assets in an estate. Pay some of those taxes using an irrevocable life insurance trust.

How long can kids stay on parent’s insurance?

How long can kids stay on parent’s insurance?

Learn when a child can transition from their parent’s insurance to their own by understanding various insurance coverage guidelines.

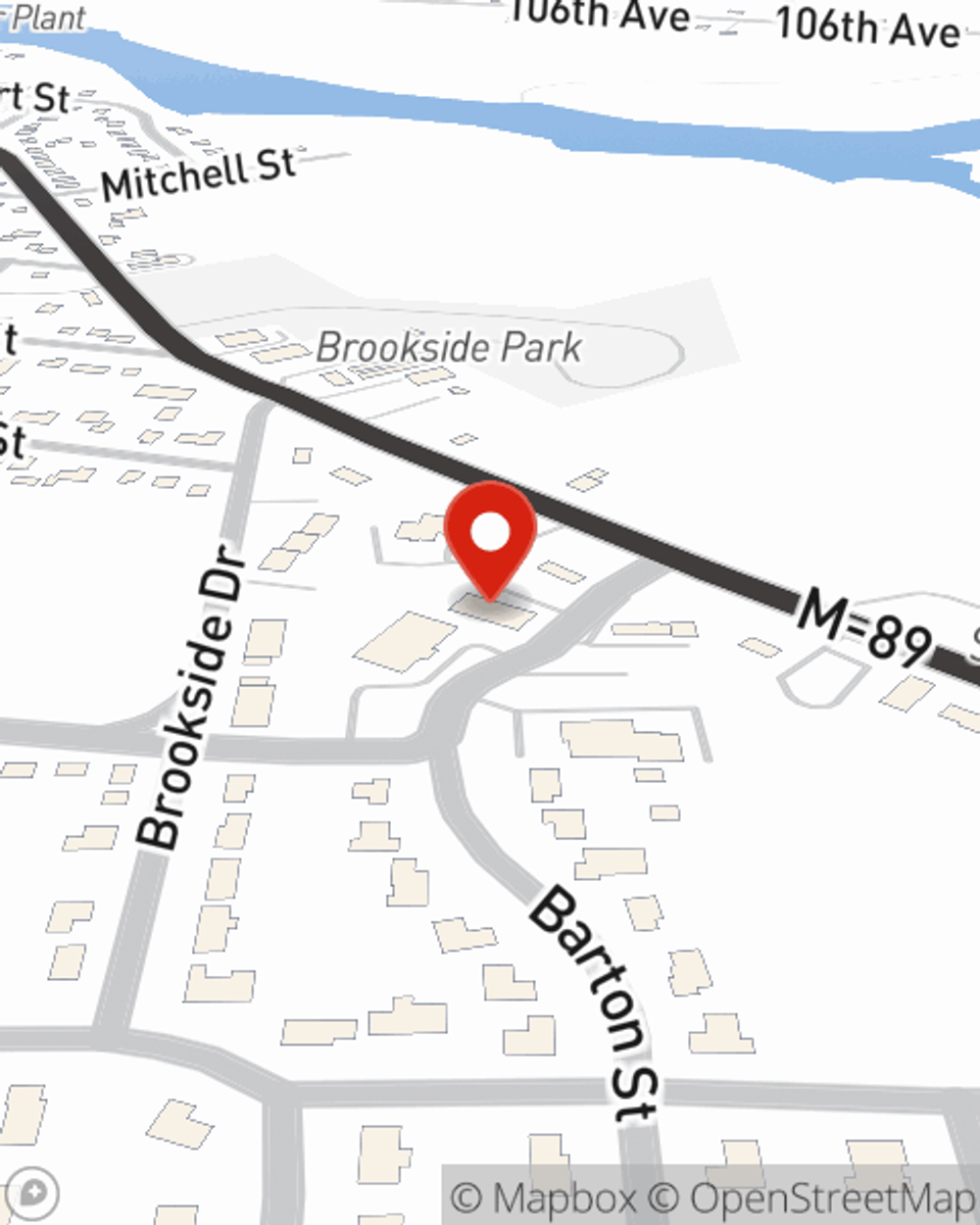

Jeremy Weitting

State Farm® Insurance AgentSimple Insights®

Irrevocable life insurance trust for a single person

Irrevocable life insurance trust for a single person

Estate taxes are imposed on all assets in an estate. Pay some of those taxes using an irrevocable life insurance trust.

How long can kids stay on parent’s insurance?

How long can kids stay on parent’s insurance?

Learn when a child can transition from their parent’s insurance to their own by understanding various insurance coverage guidelines.